17.12.2019

Qualified Opportunity Zones: A Very Short Primer

“…economists believe [Qualified Opportunity Zones] could end up becoming the biggest place-based economic development policy the federal government has…”

- “Fixing America’s Forgotten Places,” Atlantic Monthly

A low-profile but potentially high-impact feature of the Tax Cuts and Jobs Act, signed into law by President Trump on December 22, 2017, is the establishment of Qualified Opportunity Zones (QOZ’s) under Section 1400Z of the revised Internal Revenue Code. According to the US Treasury Department’s media releases, QOZs are vehicles intended to catalyze increased investment in economically distressed communities across the nation,

as measured by socioeconomic indicators such as poverty and unemployment rates.

Under the new law’s provisions, the governors of each state and territory nominate specific census tracts for QOZ status. To date, of the 74,134 census tracts in the US and its territories, 8,762 (11.8%) have been designated as QOZs. Once thus designated, each QOZ retains that status for 10 years. As the map below indicates, QOZs (indicated in dark blue) extend across the nation, including both rural and urban areas.

(While urban census tracts are less visible on the map, they are very much included in the roster of QOZs; for example, the city of Chicago alone has 133).

The overarching goal of QOZs is to leverage private sector investment to accomplish public policy aims, in this case economic development in distressed communities. The governing legislation provides for private-sector Opportunity Funds that invest in QOZs. These Opportunity Funds must maintain 90% or more investment in QOZ businesses, business assets, or real estate.

Most types of businesses are eligible (there are certain excluded businesses, such as golf courses, gambling establishments, and package stores). Opportunity Fund investments may take the form of stock, partnership interests, or tangible business property; loans are not eligible for treatment as QOZ investments.

Opportunities for Investing in Community Development

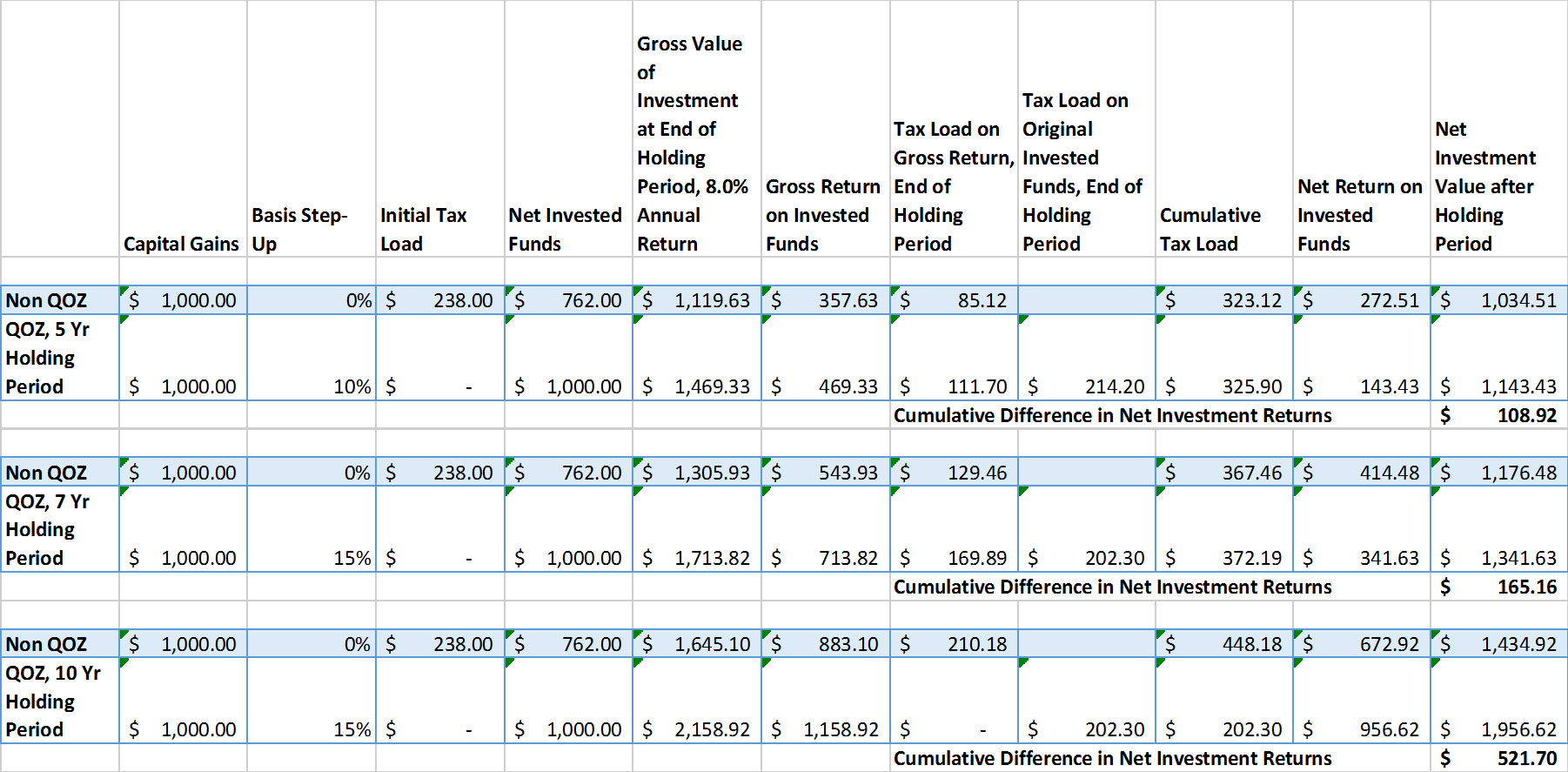

US entities holding recently realized capital gains may invest them in Opportunity Funds, thereby deferring the invested funds from taxable income. Ultimately, gains in the value of this investment may be excluded entirely from the entity’s taxable income, based on the length of the holding period. QOZ investments held for at least five years benefit from a basis step-up for capital gains tax purposes of 10% on the original investment.

For investments held at least seven years, that step-up rises to 15%. Investments held at least ten years benefit from both the 15% basis step-up and exclusion of returns on the original investment from capital gains tax. Thus, the QOZ program effectively allows significantly more investor capital to compound over time, potentially driving substantial improvements in after-tax investment returns to participating entities.

How Signet Partners Can Help

Signet Partners is a small business that has served public- and private-sector clients in the financial services industry since 1988. With offices in metropolitan Denver, Colorado and Washington, DC, we provide a focused suite of advisory services that include:

Review and oversight of underwriting and compliance for financial asset portfolios, real estate (commercial, multifamily, and residential), and federal financing programs;

Analysis, design and implementation of business processes;

Investment property feasibility and turnaround strategies;

Financial and transaction advisory and structuring services.

Our seasoned professionals offer clients and partners decades of direct, proven experience working with federal lending and economic development initiatives, including:

Federal tax credit programs, such as New Markets, Low-Income Housing, and Historic Tax Credits

Federal investment support efforts, such as the Troubled Asset Relief Program (TARP) subprograms for Term ABS Lending Facilities (TALF) and Public-Private Investment Partnerships (PPIP)

Federal financial agencies and government-sponsored enterprises, such as the Federal Deposit Insurance Corporation, Treasury Department, Small Business Administration, US Department of Agriculture, Ginnie Mae, Fannie Mae, and Freddie Mac

Work on economic development initiatives in New York City, Philadelphia and Miami

We have been institutional investors, project managers, consultants, quantitative analysts, and federal regulatory officials. In these roles, our experience spans a wide range of relevant activities, including structuring and marketing of investment funds; oversight and review of federal initiatives; and valuation and compliance oversight of hard asset and tax credit portfolios.

Signet Partners offers focused, relevant expertise at the intersection of public- and private-sector investment from the perspective of every seat at the table.

- Source: Local Initiatives Support Corporation www.lisc.org

- We assume 20% capital gains tax and 3.8% net investment income tax for the purposes of this analysis. Please note that this is an indicative example only, and is not intended as a forecast or advice to any specific parties.